Hassle-free Tax Period: The Benefits of Declaring Your Online Tax Return in Australia

The tax obligation period can commonly really feel overwhelming, but filing your tax return online in Australia supplies a streamlined technique that can reduce a lot of that anxiety. With easy to use systems supplied by the Australian Taxation Office, taxpayers profit from attributes such as pre-filled info, which not just simplifies the process but also boosts precision. In addition, the convenience of 24/7 access permits flexibility in submission. As we discover even more, it comes to be clear that the benefits extend beyond mere ease-- there are engaging reasons to take into consideration making the switch to digital filing this period.

Streamlined Filing Process

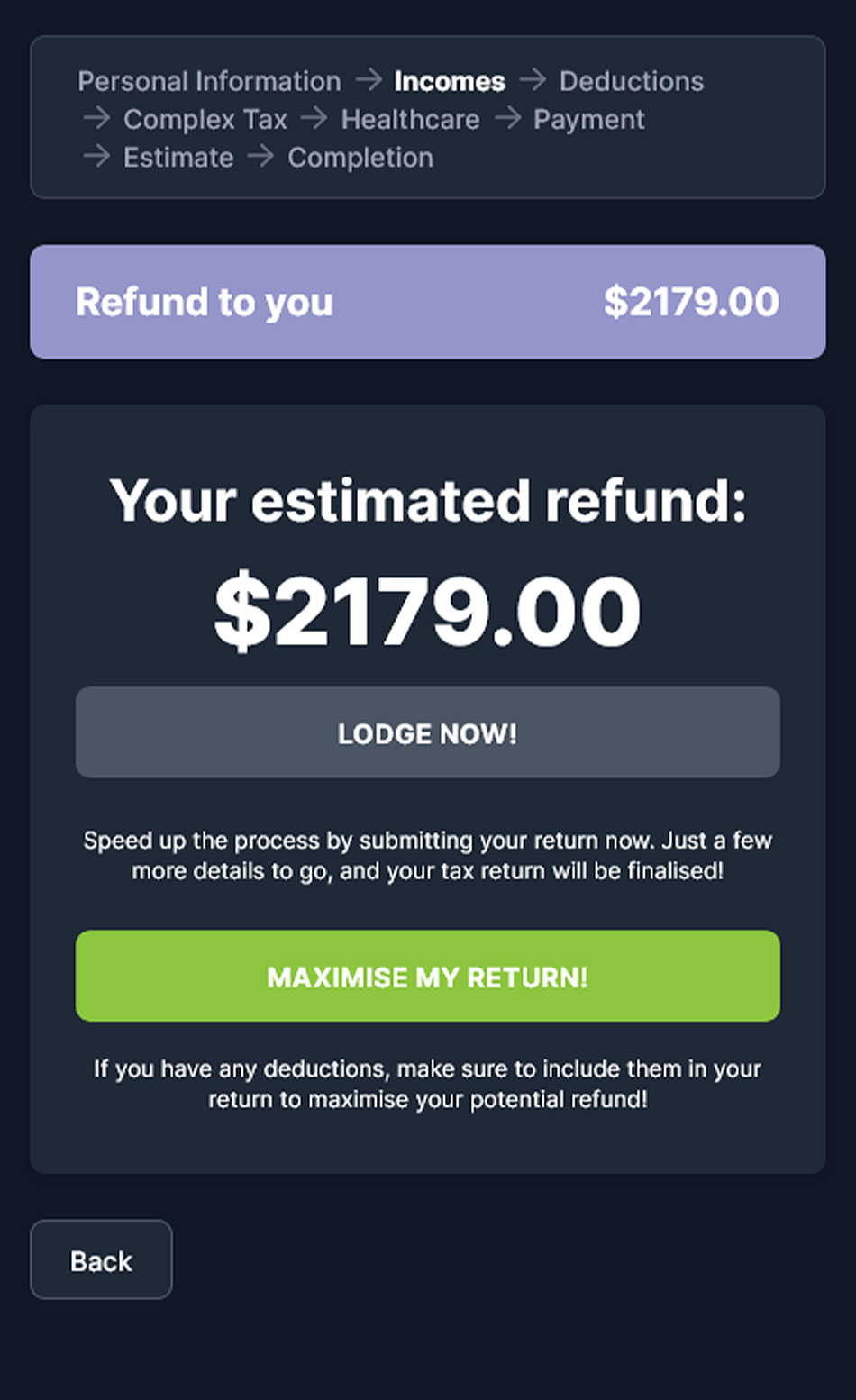

Many taxpayers often find the on-line tax return process in Australia to be effective and uncomplicated. The Australian Taxes Workplace (ATO) has made an user-friendly online system that streamlines the filing process. Taxpayers can access their accounts via the ATO website or mobile app, where they are guided step-by-step with the submission procedure.

By getting rid of numerous of the intricacies associated with typical paper forms, the on the internet tax obligation return process not just boosts quality however also empowers taxpayers to take control of their financial reporting with self-confidence. This streamlined filing procedure is a substantial improvement, making tax season less intimidating for Australians.

Time-Saving Benefits

The online tax obligation return process in Australia not only simplifies filing however also supplies significant time-saving benefits for taxpayers. Among the most noteworthy benefits is the capacity to complete the whole process from the convenience of one's home, getting rid of the need for in-person appointments with tax obligation specialists. This benefit enables people to pick a time that matches their schedules, causing enhanced efficiency.

In addition, on the internet systems commonly give user-friendly interfaces and step-by-step guidance, which help taxpayers navigate the intricacies of tax obligation declaring without considerable previous understanding. The pre-filled information offered by the Australian Taxation Office (ATO) better streamlines the procedure, enabling customers to swiftly verify and upgrade their information instead of starting from scratch.

One more benefit is the immediate accessibility to resources and assistance via online assistance sections and online forums, enabling taxpayers to resolve inquiries without delay. The ability to save progress and return to the return at any moment additionally adds to time efficiency, as customers can handle their workload according to their personal dedications. Overall, the on-line income tax return system significantly lowers the moment and initiative required to meet tax obligations, making it an appealing choice for Australian taxpayers.

Enhanced Accuracy

Boosted precision is a substantial advantage of filing income tax return online in Australia (online tax return in Australia). The electronic platforms used for on-line tax submissions are created with built-in checks and recognitions that minimize the danger of human mistake. Unlike typical paper methods, where manual computations can bring about mistakes, online systems immediately do calculations, ensuring that numbers are correct prior to submission

In addition, many on the internet tax obligation services supply features such as data import alternatives from prior tax obligation returns and pre-filled information from the Australian Taxes Office (ATO) This integration not only streamlines the procedure yet additionally enhances precision by minimizing the demand for hands-on information entrance. Taxpayers can cross-check their information much more effectively, substantially lowering the opportunities of mistakes that can cause tax obligation obligations or postponed refunds.

In addition, online tax declaring platforms usually offer immediate comments pertaining to potential discrepancies or omissions. This proactive technique makes it possible for taxpayers to remedy issues in genuine time, making sure conformity with Australian tax obligation regulations. In summary, by choosing to file online, people can gain from a more exact income tax return experience, eventually contributing to a smoother and extra efficient tax period.

Quicker Refunds

Submitting tax obligation returns on-line not just boosts precision but additionally increases the refund procedure for Australian taxpayers. One of the considerable advantages of electronic filing is the rate at which reimbursements are processed. When taxpayers send their returns online, the information is sent straight to the Australian Taxes Workplace (ATO), decreasing delays related to documents handling and guidebook processing.

Usually, on the internet income tax return are processed faster than paper returns. online tax return in Australia. While paper submissions can take several weeks to be analyzed and completed, digital filings usually result in reimbursements being released within an issue of days. This performance is especially useful for individuals that count on their tax refunds for crucial costs or monetary preparation

Eco-Friendly Option

Going with online tax obligation returns presents a green option to typical paper-based declaring methods. The change to my site electronic processes significantly dig this reduces the dependence theoretically, which subsequently reduces logging and decreases the carbon impact associated with printing, delivery, and keeping paper records. In Australia, where ecological issues are significantly paramount, embracing online tax obligation filing lines up with broader sustainability goals.

In addition, electronic submissions minimize waste generated from published types and envelopes, contributing to a cleaner environment. Not just do taxpayers take advantage of an extra reliable filing procedure, but they likewise play an active function in advertising eco-conscious practices. The digital approach allows for instant access to tax papers and documents, getting rid of the need for physical storage services that can eat extra resources.

Verdict

In verdict, submitting income tax return online in Australia provides various advantages, consisting of a structured procedure, considerable time financial savings, improved precision via pre-filled information, expedited refunds, and an environment-friendly strategy. These functions jointly boost the overall experience for taxpayers, fostering an extra lasting and effective method of handling tax obligation responsibilities. As digital options continue to advance, the advantages of on the internet declaring are most likely to end up being progressively obvious, additional motivating taxpayers to accept this modern-day method.

The tax obligation season can typically really feel overwhelming, but filing your tax return online in Australia offers a streamlined strategy that can reduce much of that anxiety. In general, the online tax obligation return go system dramatically decreases the time and effort needed to accomplish tax obligation commitments, making it an attractive option for Australian taxpayers.

In addition, lots of on-line tax obligation solutions offer features such as data import options from prior tax returns and pre-filled information from the Australian Taxes Workplace (ATO) In summary, by choosing to file online, people can benefit from a more exact tax return experience, ultimately adding to a smoother and more efficient tax season.

Generally, on the internet tax returns are processed extra promptly than paper returns.